Welcome to FinS Soup for the Soul. I do a weekly analysis of the latest technological innovation, markets, and regulatory headlines within the financial services industry. If you’re enjoying the read, feel free to subscribe by clicking below. Thanks for stopping by!

Latest headline:

Chinese state firms take a big stake in Ant’s credit scoring joint venture

Background:

Chinese state firms are poised to take a majority stake in Ant Group’s credit scoring joint venture, potentially gaining access to consumer data from its 1B+ users. Ant and Zhejiang Tourism Investment Group Co Ltd will each own 35% of the venture, while other state-backed partners, Hangzhou Finance and Investment Group, and Zhejiang Electronic Port, will each hold slightly more than 5%. Transfar Group, a non-state investor, will own 7% of the entity.

This plan, which is part of Ant’s mandated restructuring, represents one of the most prominent outcomes of a government push for state firms to exert more control and influence over a growing but lightly regulated new-economy business. The move could put Ant’s previously halted $35B IPO back into play.

The growth of a lending empire.

Over the past decade, Ant has changed how Chinese people interact with money. Ant, via its super-app Alipay, serves more than a billion users and 80M merchants that use its payment tools. It also offers third-party wealth management (170 partners), micro-loans, and insurance services (90 partners), and sells digital infrastructure to banks, insurance groups, and other traditional financial institutions.

Yu’e Bao (Chinese for “leftover treasures”), an investment product offered by the firm, became the world’s largest money market fund with $251B in assets under management in 2018. These funds were raised from the spare money lying in the digital wallets of its then 370M active users.

The company was able to exploit the arbitrage opportunities offered by the lack of access for smaller players to invest their money, as well as higher borrowing rates for idle cash due to the dearth of interbank deposits and liquidity. Yu’e Bao was able to lend to small banks at rates of up to 8% per annum, which were still lower than double-digit interbank borrowing rates. On the other hand, it could offer its investors return rates that were higher than the 3-3.5% on their savings accounts, with minimal costs.

Around a third or more of the Chinese population was invested in Yu’e Bao. The Chinese government has since stepped in to reduce the fund’s size and accompanying systemic risk to the financial markets. However, such funds have spurred Ant’s growth trajectory and placed it in the unique position of having information on the buying habits, cash flows, and creditworthiness of a large swath of users.

Furthermore, Ant used asset-backed securities to fund quick consumer loans. Asset securitisation enabled Ant to collateralise assets owned by Huabei and Bibai and issue tradable bond-like securities to generate cash. It was soon able to connect the second-largest economy's borrowers and lenders via offering short-term loans through its platform.

It takes just three minutes to process a loan and 1 second to disburse the loan, with zero human intervention. Ant's lucrative online lending business has grown to account for nearly 40% of its revenue generated in the first half of 2020.

Worries about the shadow banking economy.

Ant has become a major supply of credit to consumers and small businesses, especially those at the lower strata of the credit market. About 2 years after the initial launch of its unsecured revolving-credit product for daily expenditures, Ant Huabei reached 80M active users. About 47% of these customers were under 30 years old and 60% had never used a credit card.

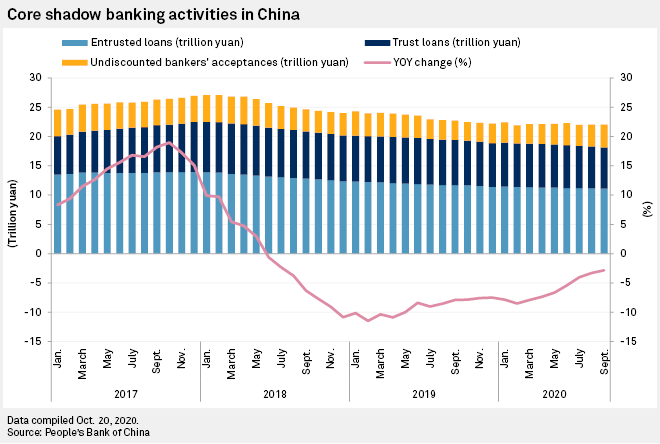

Overall, China’s core shadow banking assets have contracted between 2-3% annually since 2018. The nation has leaned on formal bank loans to support its pandemic-hit economy, instead of utilising non-bank players. Chinese financial institutions have heeded the government’s call to lend more aggressively to small and medium businesses, which previously borrowed from shadow banking channels.

However, IMF continues to caution that “China's outlook faces downside risks, stemming from rising financial vulnerabilities and the increasingly challenging external environment.”. It advised implementing a comprehensive bank restructuring framework to lower systemic risks and continue de-risking.

Ant does not deem itself a bank, but it is the largest online provider of micro-finance services in China in terms of total outstanding credit balance originated through its platform. It originates loans, 98% of which are then underwritten by financial institutions or securitised. These loans sit on the balance sheets of about 100 Chinese banks. Ant’s consumer lending balance at a sizable 1.7T yuan ($254B) accounts for 21% of all short-term consumer loans.

With only 2% of Ant’s capital deployed in the process and the risk of loan default not borne by the firm, a moral hazard exists that may spur the firm to substitute quality for quantity, and facilitate the ballooning of bad debts and a sub-prime crisis. It is no wonder then that the Chinese government has reversed its previously lax position towards fintechs like Ant and cracked down with increasing intensity.

Collecting data points from private-sector credittech.

Such a move to nationalise a credit scoring facility also begs the question regarding what would such information be used for.

Ant runs Zhima Credit (a.k.a. Sesame Credit), a private credit scoring and loyalty programme. The corporate network spans insurance, loan, historical payment, dating, shopping, and mobility data. It is roughly modelled after FICO scoring (created by the Fair Isaac Corporation) in the United States and Schufa in Germany.

It differs from FICO and Schufa by including additional social data from its ecosystem and partners related to personal characteristics (education and career), behaviour or preferences (shopping, utility, donation, and tax information), and interpersonal relationships (trustworthiness of those in one’s network). Its ratings were even used by Baihe, an online dating service, to promote bachelors with the best ratings.

Zhima Credit is not part of China’s social credit system (SoCS). However, there are some pilots linking the private systems to the government rankings. It remains unclear when and how companies might share their data with the state, although it would be difficult for them to avoid doing so if asked. The melding of governmental and private interests in the collection of consumer data could move the system much closer to the dystopian picture that appears in the media.

Conclusion:

The nationalisation of Ant’s credit scoring joint venture underscores the Chinese government’s efforts to reign in the shadow banking industry, and fits within its five-year plan targeting tech innovation, monopolies, internet finance, and big data.

With the SoCS having arrived at the end of its six-year construction phase and a new data security law coming into effect in September, it is hard to imagine China’s data-driven governance model establishing itself without the support of the country’s tech behemoths. This JV vehicle might be one of many other organisational apparatus enlisted to fulfil the vision for expanding oversight.

Tweets or treats:

Thanks for reading! If you liked this post from FinS Soup for the Soul, why not share it? Have an awesome week ahead!

China learned significant lessons from the 2008 financial crisis, not the least of which is to monitor, manage and constrain the 'shadow banking' system so as not to repeat history. When bank balance sheets and securitized loans are downstream to an opaque underwriting utility the potential for a repeat existed. Thanks for the insightful article.